Introduction

On 10 October 2022, Mental Health Australia (a peak, national, non-government organisation representing and promoting the interests of the Australian mental health sector and issues in Australia), in collaboration with global research firm Ipsos, released their first Report to the Nation – an independent benchmark survey designed to address a key gap in mental health data.

The annual national survey aims to provide a “pulse-check” of the mental health and wellbeing of Australians and identify important issues for further advocacy around mental health and wellbeing issues. Publication of the report follows hot on the heels of the recent WHO guidelines on mental health at work and is another welcome resource for mental health, HR, and WHS practitioners.

Survey sample

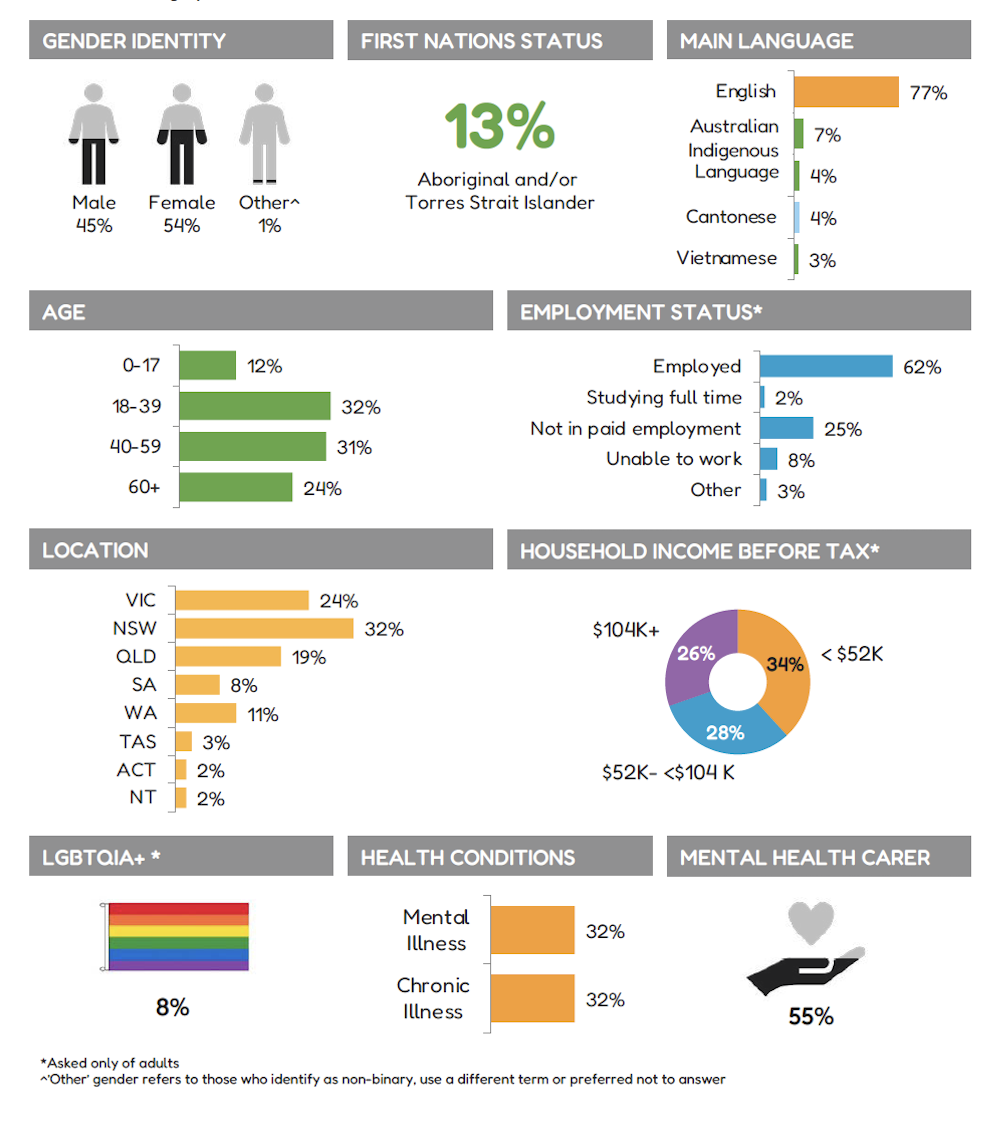

Mental Health Australia surveyed 2,537 participants (2,220 adults and 317 aged less than 18 years of age). Sixty-two per cent were employed.

Thirty-two per cent said they had a mental health illness. Fifty-five per cent said they were a carer to someone with a mental health illness.

Thirteen per cent of the sample identified as First Nations Australians. Twenty-three per cent did not select English as their main language.

Fifty-four per cent identified as female, 45 per cent identified as male, and 1 per cent did not identify. Eight per cent identified as LGBTQIA+.

Some key findings

Mental Health Australia’s Report to the Nation concluded:

“For the most part, this research suggests we are a happy and socially connected nation who support one another and have things in our lives to look forward to… However, there are many areas where our mental health and wellbeing at population level could be strengthened.”

Some of the most interesting key findings in the report included:

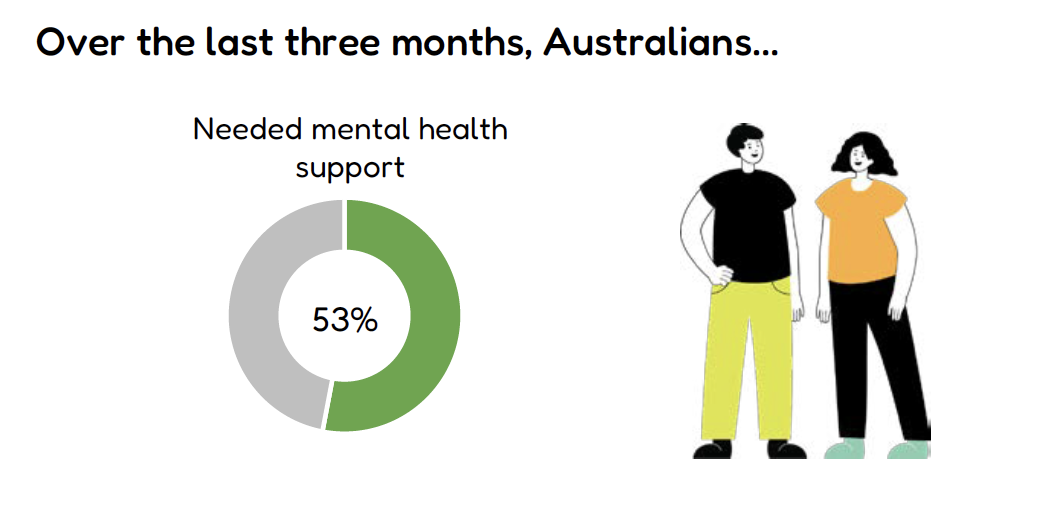

1 in 2 people needed mental health support

Fifty-three per cent of respondents (aged 14+) said they needed mental health support over the past three months.

Yet, 23 per cent of people who needed support said they either did not reach out for help or were unable to access it.

Australians experience barriers to mental health support

Fifty-two per cent of respondents felt at some time in their life they had been unable to receive the support they needed for their mental health and wellbeing.

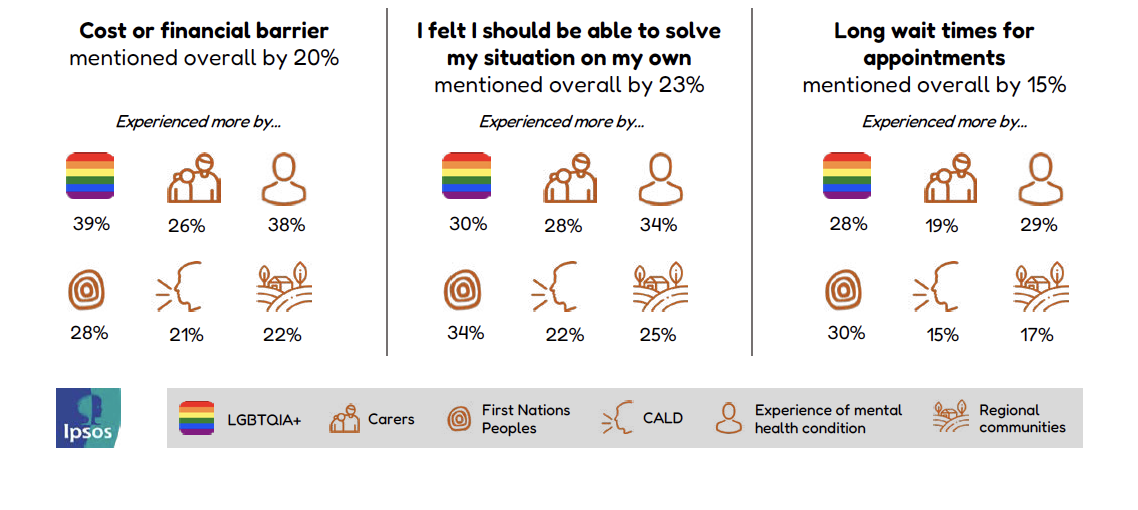

The biggest barriers identified for accessing mental health support were:

- Cost or financial barrier (20 per cent);

- Sense of responsibility to solve it alone (23 per cent); and

- Long wait times for appointments (15 per cent).

Higher rates were recorded from the following cohorts:

- LGBTQIA+;

- First Nations Peoples;

- Those with experience of a mental health condition;

- Carers;

- Regional communities; and

- Culturally and linguistically diverse (CALD) communities.

People reported three main sources of mental health and wellbeing support

But, given that two of these three options typically require a financial cost (and sometimes a long wait time), and, even with friends and family, many people feel they should be able to solve the situation on their own, these results suggest there are access barriers even for our top three preferred support pathways.

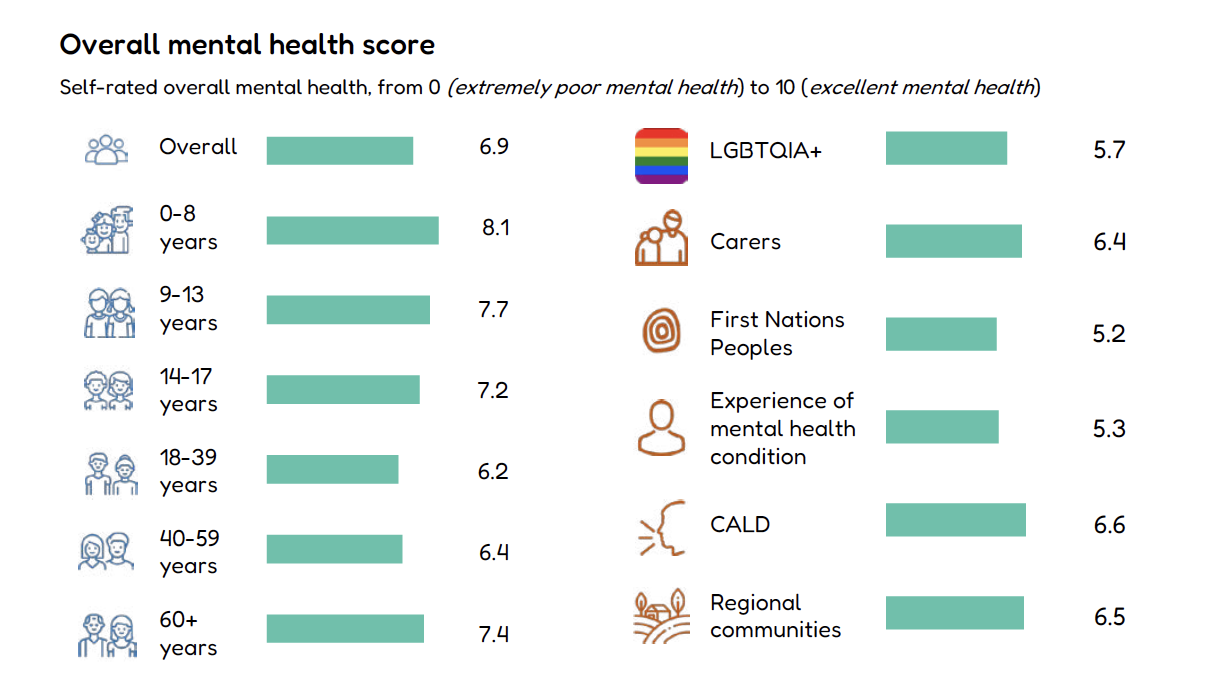

No adult cohort reported a high mental health score

Whilst there was variance across the different population groups, the average mental health score for adults was 6.67 out of 10 – with lower scores recorded for each of the six cohorts identified on the right-hand side of this infographic:

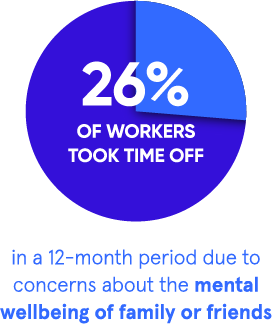

The results are in line with our research last October, which found:

Business and institutional leaders who prioritise employee and student wellbeing, productivity, and resilience should take note of these results given that, “many studies show a direct link between productivity levels and the general health and wellbeing of the workforce”.

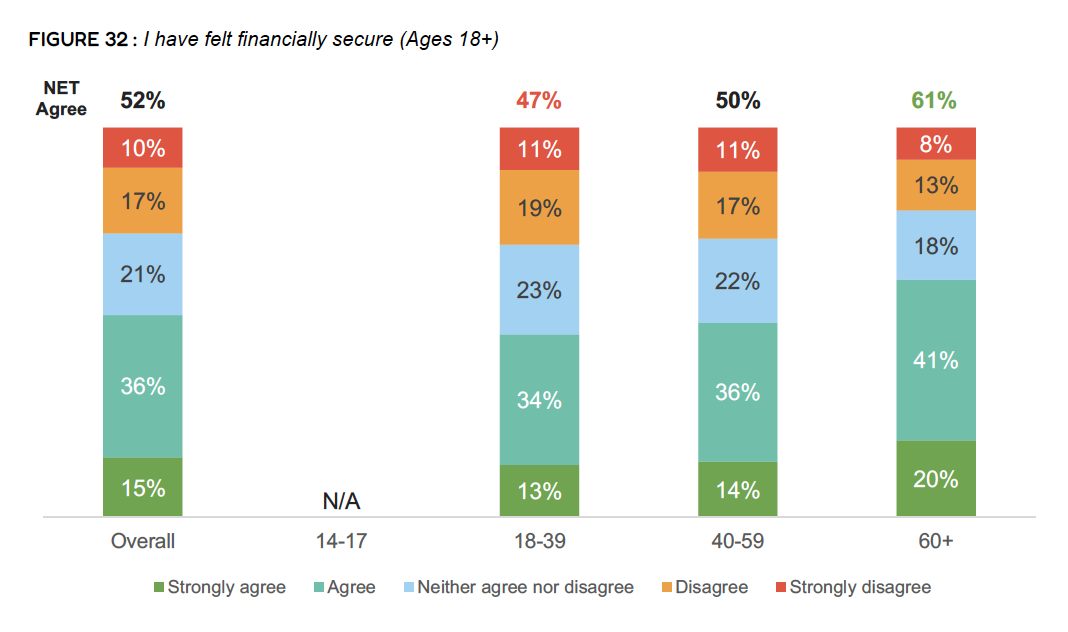

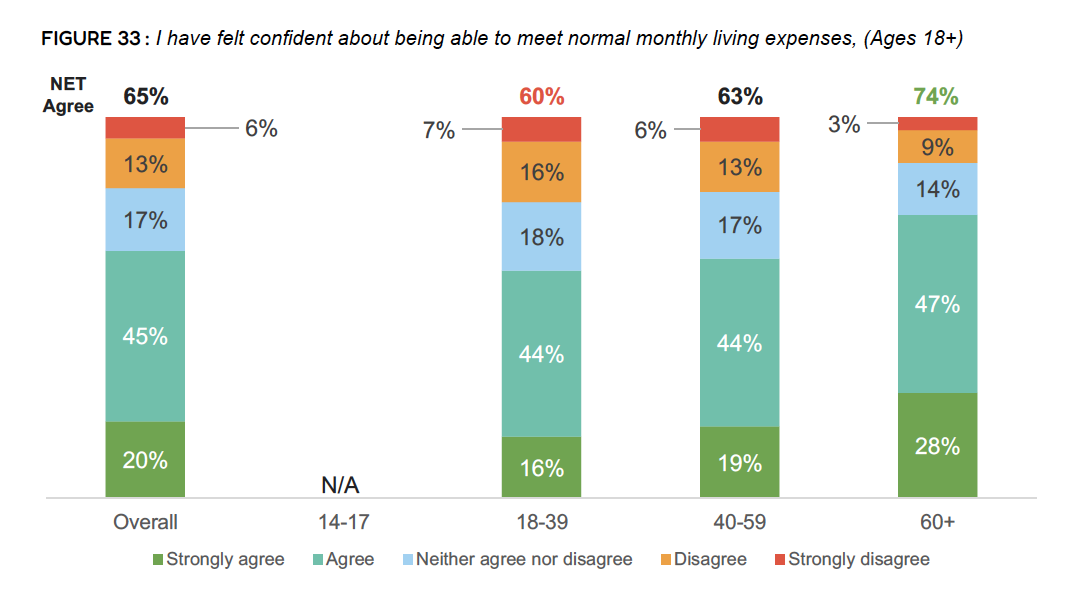

Many Australians are experiencing financial pressures

The Report to the Nation warned that “levels of financial and job security are worryingly low.” One in two people reported feeling financially insecure, and only 65 per cent reported feeling confident to meet normal monthly living expenses.

These findings are consistent with our recent comments about the need to support workers who are experiencing cost-of-living pressures.

The link between mental, financial, and physical wellbeing is well documented. A recent Australian study found that COVID-19 – and its disruption to our social world and financial stability – was a primary cause of mental health distress. This was backed up by an earlier study published by the British Psychological Society which found that money worries had a potential impact on worker health due to “increased work-family conflict and stress associated with financial insecurity.”

Dr Jamie Phillips, Sonder’s Medical Director and a practising physician in emergency medicine and remote medicine is acutely aware of the difficult compromises that employees are making to the detriment of their overall health.

“People are having to make difficult health-purchasing decisions and are prioritising their basic human needs, such as paying their rent or mortgage over paying for prescriptions or seeking medical care. Too many Australians are not getting the help they need, and this has been exacerbated by the recent cost-of-living stress on household budgets.”

—Dr Jamie Phillips

Medical Director, Sonder

In addition to the mental health effects of financial insecurity are the physical health implications of workers missing vital medical appointments or not filling their prescriptions due to out-of-pocket costs.

Dr Phillips cautions that financial insecurity has broad implications for individuals, their families, their employers, their communities, and the wider society.

“Left untreated, problems escalate, which means higher treatment costs for individuals, plus increased absenteeism and lost productivity at work.”

—Dr Jamie Phillips

Medical Director, Sonder

Summary

Mental Health Australia’s Report to the Nation delivers timely insights into the mental health and wellbeing of Australians.

The onus is now on business and institutional leaders to combine these insights with data from inside their organisations as they strive to implement meaningful, evidence-based change for organisational wellbeing.

Want to learn more?

To read Mental Health Australia’s Report to the Nation, please click here.

For more information on how Sonder can help your organisation reimagine safety, medical, and mental health support, please contact us here.

About Sonder

Sonder is a technology company that helps organisations improve the wellbeing of their people so they perform at their best. Our mobile app provides immediate, 24/7 support from a team of safety, medical, and mental health professionals – plus onsite help for time-sensitive scenarios. Accredited by the Australian Council on Healthcare Standards (ACHS), our platform gives leaders the insights they need to act on tomorrow’s wellbeing challenges today.