The TL;DR:

- The rules around fringe benefits tax and EAPs differ from country to country.

- In some cases, EAPs can be exempt from fringe benefits tax if certain conditions and criteria are met.

- Seeking advice from a tax professional about your company’s EAP offering is essential to ensure you have an accurate understanding of your potential tax liability.

As an employer, there are many expenses that can impact your profitability. It’s why many companies invest in specialist accounting and financial support to tackle key challenges, like navigating tax liabilities.

The rules around Employee Assistance Programs (EAPs) and fringe benefits tax (FBT) are incredibly complex and vary from country to country. For example, in Australia there are a number of limitations in place that narrow the scope of what can be considered an FBT exemption-meaning many services offered by EAPs will be considered a taxable benefit.

But even with the potential tax implications, EAPs offer huge perks for companies, from reducing stress to offering non-traditional benefits like boosting productivity and employee retention.

In this guide, we explain the fringe benefit tax rules that apply to EAPs in Australia, New Zealand, and the UK to help you understand what exemptions you may have access to.

Fringe benefits tax: what employees need to know

Before we dive into region-specific tax rules, let’s get a few definitions sorted. Fringe benefits tax (FBT) is a specific type of tax paid by employers. It kicks in when employers provide benefits to employees and can even extend to benefits offered to an employee’s family.

It’s important to remember that FBT is different from income tax, and the cost you’ll need to pay is calculated based on the taxable value of the fringe benefits you’re offering.

Fringe benefits defined

So, what is a fringe benefit exactly? While each country has its own definitions, fringe benefits broadly relate to the perks you offer to employees outside of their salary or wages.

This includes things like:

- Offer subsidised car parking or a commuting allowance

- Covering the costs of gym memberships

- Offering a discount on an employee’s health insurance

The exact amount you’ll need to pay varies depending on where your company operates. But typically, you’ll need to add up the total cost of the benefit (taxable value) and multiply it by an FBT rate. Then, you’ll need to pay this amount when you lodge your FBT return.

Claiming tax deductions on fringe benefits

Again, we’ll dive into the region-specific rules around deductions for fringe benefits shortly. But in general terms, you should be able to claim a tax deduction on at least a portion of the cost of offering fringe benefits. The deductible amount depends on whether you’re claiming things like GST credits (Goods and Services Tax).

EAPs and taxable benefits: region-specific advice for employers

Now for the bit you’ve been waiting for: are Employee Assistance Programs (EAPs) considered a taxable benefit under Fringe Benefits Tax?

Across Australia, New Zealand, and the UK, different rules apply regarding fringe benefits tax and what is considered a taxable benefit. Plus, some regions offer exemptions for certain types of benefits, which may include EAPs. To ensure you’re aware of the tax rules in your region, we’ve curated a country-specific guide to EAPs and the fringe benefit tax rules that are likely to apply to you.

Are EAPs tax deductible for Australian employers?

In Australia, EAPs are considered a fringe benefit. This means that employers can claim an income tax deduction on the costs of providing an EAP to their employees.

Australian employers need to self-assess their FBT liability on an annual basis, covering the period 1 April to March 31. If you do have an FBT liability, this needs to be lodged as an FBT return and paid to the Australian Tax Office (ATO).

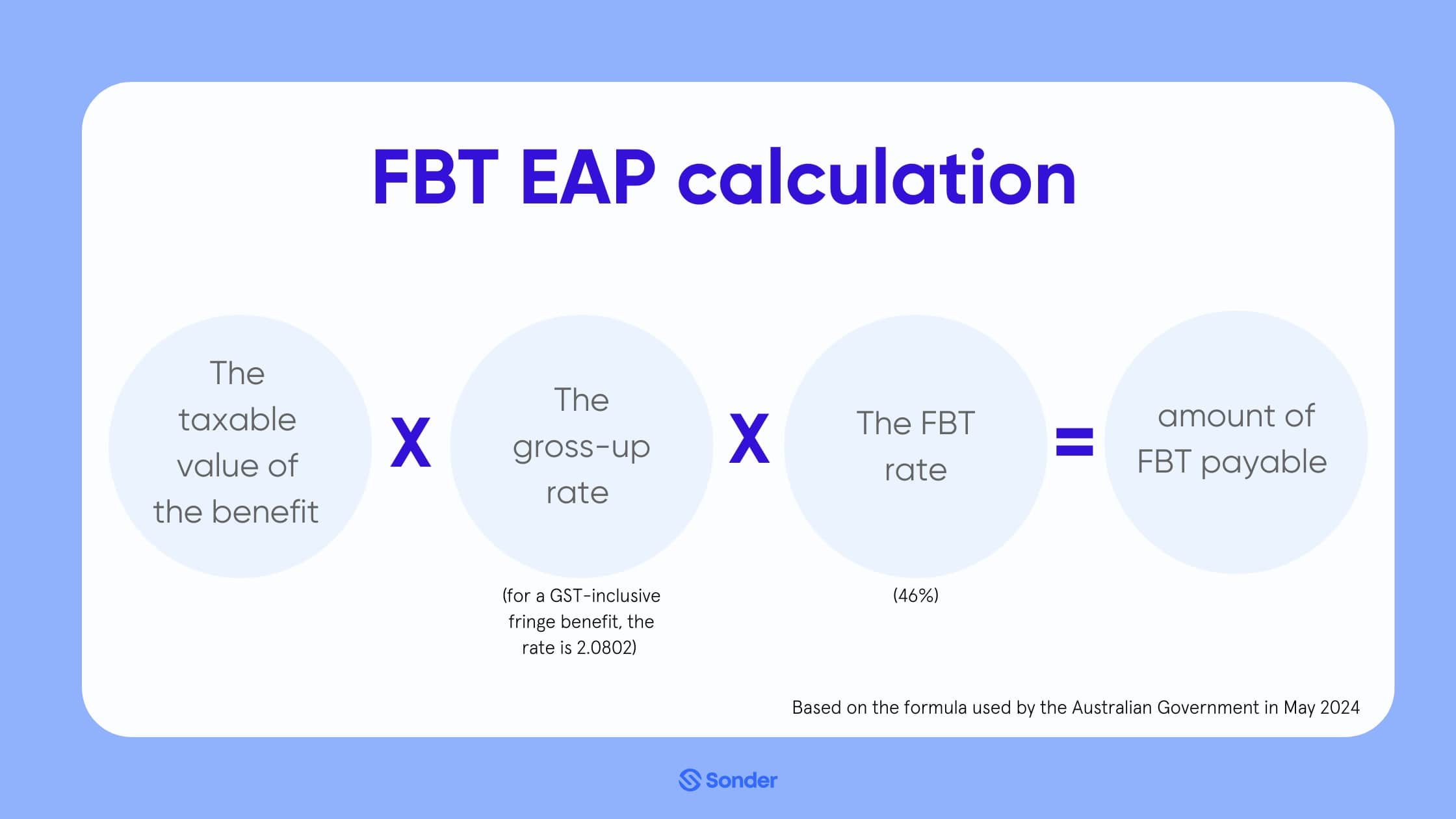

The amount of FBT you pay on EAPs in Australia is calculated based on the following formula:

The taxable value of the benefit x the gross-up rate (for a GST-inclusive fringe benefit, the rate is 2.0802) x the FBT rate (47%) = amount of FBT payable

Alternatively, you can use this guide and range of interactive calculators from the ATO to figure out your FBT liability.

Plus, employers are able to claim a number of tax deductions for EAPs, including:

- An income tax deduction and GST credit for the cost of the EAP

- An income tax deduction for the FBT paid

????Important: if you’re offering EAPs to your employees, you’ll need to lodge your FBT return and pay the amount owed by May 21 (unless your tax agent lodges this on your behalf or you’re granted an extension of time). In some cases, you may be able to pay FBT in quarterly instalments aligned with your business activity statements.

Depending on the scope of your EAP, some exemptions may apply. For example, under Section 20.8, “work-related counselling” is listed as an exempt benefit from FBT. However, it’s important to speak with a tax professional to gain tailored advice about whether your company’s EAP qualifies as a taxable benefit or not.

Are EAPs tax deductible for New Zealand employers?

In New Zealand, the rules are less clear around whether EAPs are considered a fringe benefit.

That’s because non-cash benefits related to ‘health and safety‘ can be exempt from fringe benefits tax (under section CX 24 of the Income Tax Act 2007). To meet this criteria, the benefit on offer needs to be linked to an employee’s health and safety and mitigating health and safety risks in the workplace.

Another key element of being a fringe benefit exemption is this: the benefit needs to be used on the employer’s premises. For example, if your EAP is limited to a targeted on-site program that tackles workplace-related stress, it may qualify as an exemption.

If your EAP is considered a fringe benefit by the Inland Revenue Department (as a ‘free, subsidised or discount service‘), fringe benefits tax (FBT) will be payable on it. There are a range of different FBT rates companies can use to calculate how much you’ll need to pay based on a range of factors (such as whether you want to file quarterly or annual FBT returns).

As you can tell, FBT rules in New Zealand are complex and nuanced. The best way to find out what tax rules apply to your company is to speak with a tax professional who can provide tailored advice and personalised recommendations.

Are EAPs tax deductible for UK employers?

Again, there is a lot of nuance to consider about whether EAPs are considered a tax benefit in the UK.

According to the UK Government, counselling for employees is considered an exemption from fringe benefits tax. However, it needs to be available to all employees and focused on ‘welfare issues, such as bereavement, ill health or stress, problems at work, sexual abuse or personal relationship difficulties’.

But this exemption won’t apply if your counselling services cover:

- Tax advice

- Legal advice

- Financial advice (outside of resolving debt problems)

- Advice about leisure or recreation

- Medical treatment (outside of counselling services for Cognitive Behavioural

- Therapy or interpersonal therapy)

Tax professionals in the UK explain that if your EAP covers a wide range of counselling services (both allowable and non-allowable under the UK’s FBT rules), the exemption would not apply across the entire program.

This is backed up by the UK Government’s HM Revenue and Customs website. As EAPs usually offer a broad range of services, most programs won’t qualify for an FTB exemption as it’s “difficult to determine where to draw the line between counselling that falls within the exemption and counselling that is outside of the exemption.”

If FBT does apply to your EAP, you’ll need to report it to HM Revenue and Customs (HMRC) and pay tax as well as National Insurance on these benefits.

Again, the best way to discover what exemptions may apply to your company is to speak with a tax professional.

The way forward with Employee Assistance Programs and their alternatives

Understanding your tax obligations is a crucial part of deciding what EAP is right for your company. From there, you need to consider what scope of services is going to be most impactful to the health and wellbeing of your team.

At Sonder, we believe preventative care is the best way to safeguard the health, happiness and productivity of your workforce. It’s why we offer an EAP alternative via a platform that’s available 24/7 as a mobile app, backed by on-demand human support from experienced medical, safety and wellbeing specialists.

Want to learn more? Dive deeper into the world of EAP alternatives and discover how they can transform your organisation with our ultimate EAP buyer’s guide.

- Learn how to compare vendor offerings

- Discover what makes EAP alternatives different

- Gain insider tips and statistics

- Write a convincing business case

Want to learn more?

Ready to experience a modern approach to employee care?

Contact Sonder today to discover how our platform can benefit your organisation.